Asset Power Account

Your investment is like an unpolished gemstone, waiting for a high-caliber team of experts to unleash its full potential.

As your investment companion, we understand that financial flexibility is significant to keeping your investment plan on track. Accordingly, we dedicate ourselves to supporting you to unleash the full potential of your investments by introducing our new wealth management service Asset Power Account (“Asset Power”)# to high net worth customers1. Asset Power strengthens your investment power through competitive financing rates and extra financial flexibility to enhance potential returns.

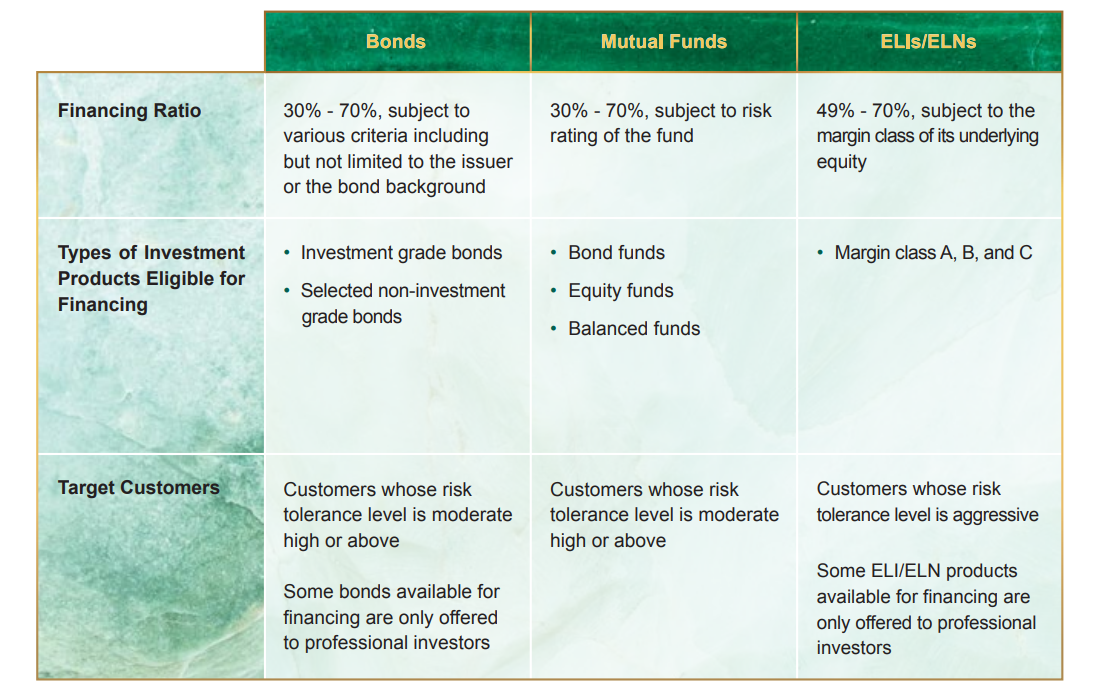

Diversity through offering you multi-asset investment options which include Mutual Funds, Bonds, and Structured Products, such as Equity-linked Investments (ELIs) and Equity-linked Notes (ELNs) etc

Competitive Financing Rate2 that creates greater potential investment yield through portfolio financing

Flexibility by offering additional purchasing power of up to 70% of the value of your investment assets in the account for reinvestment3

Exclusivity of special offers:

Notes:

#Asset Power is subject to such terms and conditions as Everbright Securities Investment Services (HK) Limited may impose or stipulate from time to time.

1 A “high net worth client” refers to an investor who has total investable assets of not less than HK$8 million.

2 The financing rate is subject to review from time to time and is determined by Everbright Securities Investment Services (HK) Limited.

3 The margin ratio and the credit limit are determined by Everbright Securities Investment Services (HK) Limited.

Investments involve risk. Please click here for the Disclaimers and Risk Disclaimers.

As a multifaceted professional financial services company established for more than 50 years, we find creative, practical and cost effective solutions to unlock value within clients’ portfolios. With an unstinting focus on devising appropriate long-term wealth accumulation strategy for you and your family, Asset Power centers on diversified yield enhancement solutions, coupled with objective and pertinent insights, to aim for sustained pace of growth of your wealth. Explore to uncover other range of investment products, services and expertise available.

Asset Power is designed specifically for wealthy individuals with a moderate high to aggressive risk tolerance seeking a holistic and service-led approach to wealth management specifically geared to yield enhancement with an expansive suite of exclusive rewards, privileges and services.

As a high net worth client, you simply need to create an investment portfolio valued at least HK$3 million (including cash) in your Asset Power account to get access to our customized investment services.

Whether you want to preserve your wealth for your own financial security or for the benefits of your future generations, or build a long-term investment plan, our proven experience and invaluable connections will ensure that your future lives up to your life expectations.

Our wealth manager will illustrate on how your yield could potentially look under different interest scenarios and margin ratios. Once we have drawn on detailed insight into your wealth, we can create a portfolio-based wealth solution at each stage of your wealth journey.

As your wealth accumulates, the need for focused insights and analyses will vary accordingly. Strategies that match your evolving needs and preferred level of involvement in your investment decisions should take into account of:

Asset Power brings together a unique blend of client experiences and technology innovation including:

Disclaimers

Asset Power Account (“Asset Power”) is only designed to cater for high net worth investors with an appropriate risk appetite, financial situation, experience, investment objectives and the ability to bear potentially substantial loss as it carries significant risks. Asset Power and the products available through it may not be suitable for all types of investors. For more information on the features, benefits and risks of different types of investment, please contact your wealth manager and refer to the Risk Disclosure Statements appended to the Client Agreement and Schedules of Everbright Securities Investment Services (HK) Limited.

In general, investors are exposed to market risk, liquidity risk, the issuer’s credit risk and the risk of the underlying financial instrument(s).

Nothing in this webpage should be construed or relied upon as legal or financial advice. Instead, this webpage is intended to serve as an introduction to the Asset Power.

Risk Disclosure Statements

Asset Power is a margin securities trading account. The risk of loss in financing a transaction by deposit of collateral is significant. You may sustain losses in excess of your cash and any other assets deposited as collateral with Everbright Securities Investment Services (HK) Limited. Market conditions may make it impossible to execute contingent orders, such as “stop-loss” or “stop-limit” orders. You may be called upon at short notice to make additional margin deposits or interest payments. If the required margin deposits or interest payments are not made within the prescribed time, your collateral may be liquidated without your consent. Moreover, you will remain liable for any resulting deficit in your account and interest charged on your account. You should therefore carefully consider whether such a financing arrangement is suitable in light of your own financial position and investment objectives.

Investment involves risk. Investors should note that past performance is not a guarantee of future returns. The investment value may be affected by market fluctuations. The investment products or services mentioned here are not equivalent to, nor should it be treated as a substitute for, time deposit or any other form of savings deposit. Investors must read the prospectus or offering documents of the relevant investment products, in particular the risk disclosure statements of the relevant prospectus or offering documents before subscribing to or purchasing any investment product. The investment decision is yours, regardless of whether the intermediary who sells them has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives. Therefore, before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk tolerance level and ability to understand the nature and risks of the relevant product.

If you have any inquiries on these Risk Disclosure Statements or the nature and risks involved in trading or investing in any investment products, you should seek advice from independent financial adviser. Any information or opinions contained in this webpage does not constitute an invitation or offer to purchase or subscribe to any securities or investment products or any investment advice from any member of Everbright Securities International group or its directors, representatives and employees.

This webpage is published by Everbright Securities Investment Services (HK) Limited, a member of Everbright Securities International. lt has not been reviewed by the Securities and Futures Commission in Hong Kong.

General Disclaimer:

This document is based on information available to the public. The information and opinions contained herein are for investors’ reference only and do not constitute investment advice, investment consulting and financial or legal advice for anyone. Nothing in this document shall be considered as an invitation, recommendation, guarantee or publicity to subscribe/purchase/sell securities or other financial instruments. Investors shall take the risk of their own investment based directly or indirectly on this document. Regardless of whether the document has been directly or indirectly referred to, Everbright Securities International and/or its affiliates shall not be liable or held liable for any direct or indirect losses or consequences caused by usage of the content of the document.

Everbright Securities International and/or its affiliates make no express or implied statement and do not guarantee the accuracy, completeness, or reliability of any information contained in this document. The information contained in this document may be changed due to changes in the reports, information, or data on which it is based. Everbright Securities International assumes no obligation to update the document or to notify of any modification to the document.

This disclaimer applies in all situations. When jointly used with other written information or verbal introduction, this document is completely independent of other written information or verbal introduction regardless of the specific usage of scenario or method. The quality of other written document or verbal presentation does not cause this disclaimer to be inapplicable.

Copyright of this document belongs to Everbright Securities International. Without written permission from Everbright Securities International, any form of unauthorized distribution, reproduction, publication, release or quotation is prohibited.