|

How can a regular savings plan help you achieve your financial objectives?

1. Flexibility

- You are given the flexibility to choose your own level of protection and investment.

- Subject to the relevant terms and conditions, you may vary the amount of premium payments or coverage according to your changing financial circumstances.

- Subject to the relevant terms and conditions, you may temporarily stop the premium payments according to your financial situation.

- You can choose from a number of funds to invest in, depending on the level of risk that you are comfortable with.

- Investment in growth or equity-related funds may give higher returns than traditional life insurance plans over the long-term. However, you have to bear in mind that with higher returns come greater risks.

Please check the policy, product summary and other related documents for information on the various charges.

2. Portfolio diversification with a number of fund choices

- Investment-linked insurance plans let you choose from a number of investment-linked funds, managed by professional fund managers. It is important to select funds that suit your financial goals and risk profile, for better risk control.

- Depending on the relevant terms and conditions, investment-linked insurance plans may also allow you to switch your money from one fund to another to suit your financial situation and risk profile as they change over time. Before switching from one fund to another, check whether you are entitled to free switches and if not, how much you would need to pay for the switch.

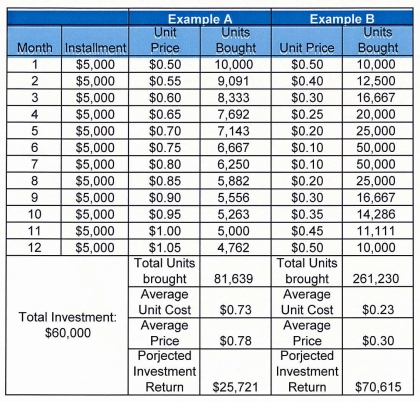

3. Dollar cost averaging

- Dollar cost averaging involves investing a fixed amount of money regularly, regardless of market conditions, instead of investing all your money in one go. Regular investment means that you buy more shares/units when the prices are low and less when the prices are high. This evens out the risk of buying high and selling low, and may result in a lower average cost per unit over time.

- Dollar cost averaging means that you do not need to guess what will happen next in the market, as it has no bearing on your decision to invest.

4. Power of compound interest

- The compound interest effect is the interest earned on reinvesting interest, in addition to the original sum.

- The sooner you start to save, the greater the benefit of compound interest.

Compound interest effect: Time = Money!

When there is sufficient time, the compound interest effect can help grow your small amount of money into a tremendous asset.

Assume monthly savings of: $3,000/mth

5. Diversification

- Investment-linked plans offer you access to different portfolios to help you diversify your investments and protect against the risk of "putting too many eggs in one basket". You can diversify your portfolio by investing in different financial tools, economic sectors and even regions.

What are the risks involved in purchasing an investment-linked insurance plan?

- Investment-linked plans, like other types of investments, involve exposure to investment risk. Since an investment-linked plan is linked to the unit price of investment funds, the total value of the plan fluctuates with movements in the unit price.

- When the unit price falls, the value of the investment will also be reduced, and vice versa. The plan may result in a gain or loss when you sell your units.

- Past performance of the investment-linked plan’s fund record is not a guarantee of its future performance.

Some factors you should consider before purchasing an investment-linked insurance plan

Once you have decided on buying an investment-linked insurance plan, you should consider factors such as the amount of the investment, the choice of either single or regular premium plans, fund choices, and the level of protection you need. Buying such a product is like having a personalised plan tailored to meet your special financial needs. It is important that you evaluate your options carefully to find the right plan with the right fund to suit your needs. There are a few things that you must consider when buying an investment-linked insurance plan:

- Risk profile – Your risk profile refers to how much investment risk you are willing to bear. It varies from individual to individual, and changes from time to time as your financial situation and investment objectives change. The cash value of an investment-linked plan depends on the performance of the investment-linked funds selected. The returns are not guaranteed. If you invest in an investment-linked plan, you need to be prepared that the cash value of your policy will fluctuate according to fund performance. You need to re-evaluate your investment at different points in time as your risk profile changes.

- Investment objective – Different investment-linked funds focus on different asset classes, geographical regions or industry sectors, and have different levels of volatility. It is important to select a fund that is commensurate with your risk profile and investment objectives.

- Time horizon – This refers to the period that you can stay invested before you expect to cash out your investment. Regular premium investment-linked plans are generally regarded as long-term insurance plans, set according to your investment objective. A longer time horizon is particularly important when investing in these types of plans, as there are usually significant charges in the early policy years.

- Fees and charges – There are various types of fees and charges which will reduce the value of your investment.

- Cash value accumulation – Regular premium investment-linked plans may not accumulate adequate cash value during the early policy years. This means that if the policy is terminated during the early period, you may not recover the value of your investment. Please pay attention to the ICP (Initial Contribution Period) of the investment-linked plan.

- Fund switching – Should you feel that you have made the wrong choice or you would like to change the profile of your investment portfolio, you have to find out from the relevant terms and conditions whether you are allowed to switch your units from one investment fund to another and any fees or charges for the switches.

|